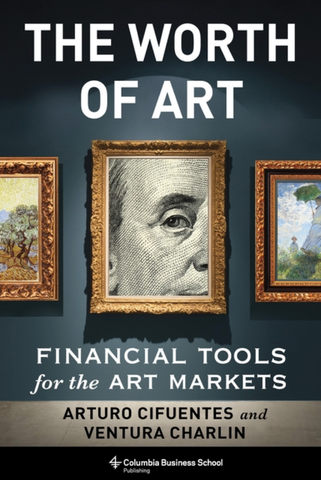

The Worth of Art: Financial Tools for the Art Markets

**if not in-store, please allow up to 2 weeks for delivery** หากหนังสือหมดจากหน้าร้าน เราจะส่งภายใน 10-14 วัน**

In recent years the art market has grown in both size and importance. It is currently estimated that ultra-high-net-worth individuals (UHNWIs) maintain 6% of their holdings in art-related assets; thus, at least US$ 1.75 trillion are invested in art worldwide. This figure does not take into account the holdings of museums, banks, endowments, insurance companies, and other institutional investors. Artistic objects, notwithstanding their aesthetic merits, can also be valuable financial assets. This book shows readers with finance backgrounds how to use the analytical tools employed in more conventional markets (stocks, bonds, real estate) to assess the risk and rewards associated with participating in the art market as an investor, collector, banker, insurer, lender, auctioneer, speculator, etc. The book demonstrates the use of data analytics and statistics for art valuation vs. subjective appraisal based on connoisseurship.

The market for art can be as eye-catching as artworks themselves. Works by artists from da Vinci and Rembrandt to Picasso and Modigliani have sold for hundreds of millions of dollars. The world's ultrawealthy increasingly treat art as part of their portfolios. Since artworks are often valuable assets, how should financial professionals analyze them?

Arturo Cifuentes and Ventura Charlin provide an expert guide to the methods, risks, and rewards of investing in art. They detail how to apply the financial and statistical tools and techniques used to evaluate more traditional investments such as stocks, bonds, and real estate to art markets.

The Worth of Art: Financial Tools for the Art Markets shows readers how to use empirical evidence to answer questions such as: How do the returns on Basquiat compare to the S&P 500? Are Monet's portraits as valuable as his landscapes? Do red paintings fetch higher prices than blue ones, and does the color palette matter equally to the sales of abstract Rothkos and figurative Hockneys? How much should be loaned to a borrower who is pledging one of Joan Mitchell's late abstract paintings as collateral? Would the risk-return profile of a conventional portfolio benefit from exposure to Warhol?

Rigorous and readable, this book also demonstrates how quantitative analysis can deepen aesthetic appreciation of art.

2.79 cms H x 23.19 cms L x 15.01 cms W 272 pages, Hardcover, September 2023.

We Also Recommend